The Basics on Auto Insurance

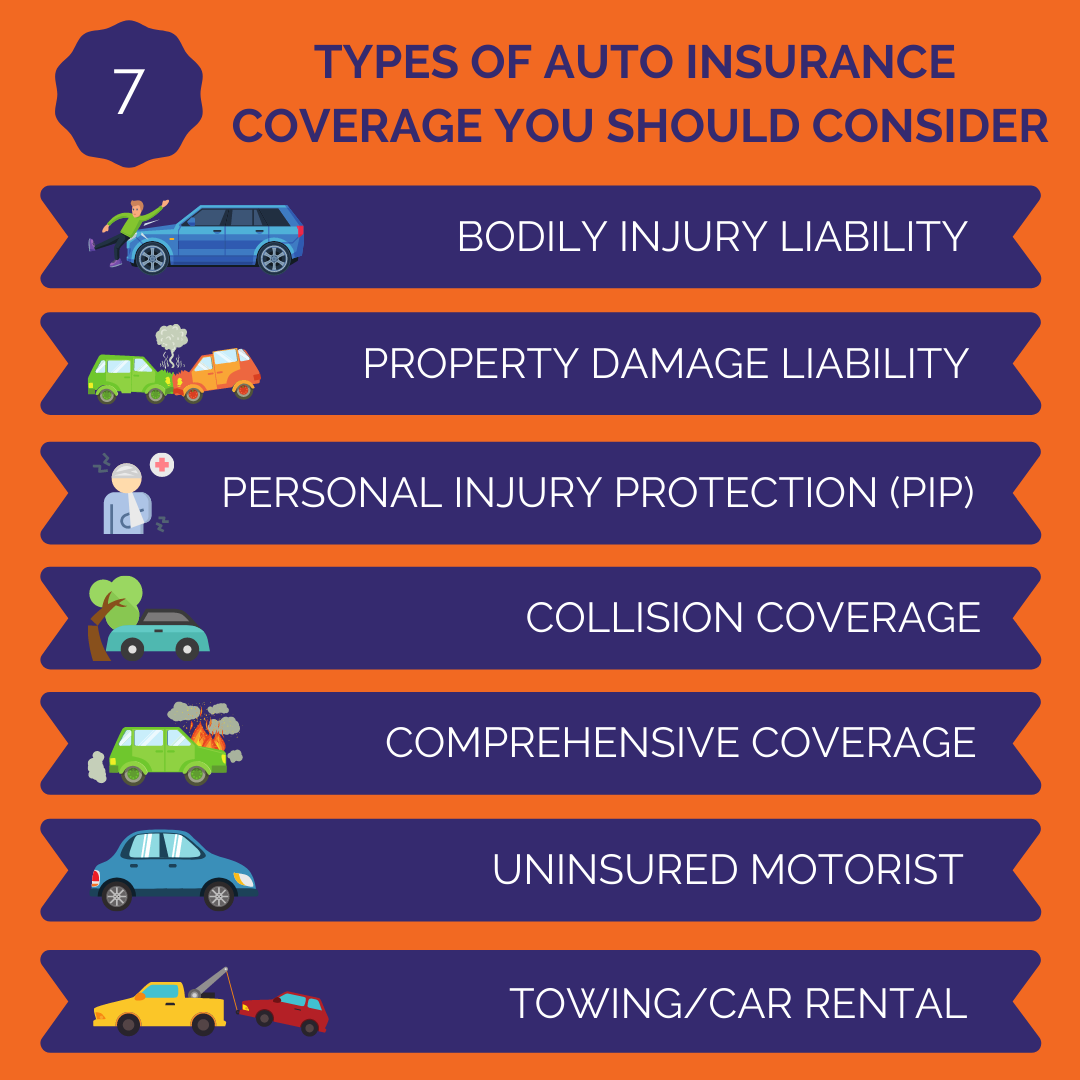

Auto insurance is legally required, but many aren’t informed about what certain policies actually mean for them and their vehicles. We’ve broken down the different types of auto insurance, and who would benefit the most from each policy to make selecting your auto insurance a decision you can feel good about.

Liability

Liability insurance is the minimum amount of insurance you need to legally drive. This type of policy covers the other party and their car in an accident that is deemed your fault. For example, if you accidentally rear-end someone, and both of your cars are damaged, a liability policy would pay for the damages to their car, but not the damages to yours. Liability normally comes at a more affordable rate than other auto insurance policies, but it also comes with the risk of not having your person and car covered in the case of an accident you caused.

Comprehensive and Collision

Comprehensive and Collision insurance, commonly known as full coverage, is not required by law, but it does offer a variety of benefits for the policyholder. Similar to liability insurance, if you cause a car accident, your insurance will cover damages incurred on the other party, AND it will also cover any injuries you may have as well as any damage done to your car. This type of policy also covers non-accident related damage to your car such as hail and even theft. While these policies typically cost a little more than liability policies, they come with additional peace of mind that you and your car will be taken care of in case of an accident.

Which Policy is Right for Me?

Liability insurance could be a good choice for more experienced drivers who are less likely to cause an accident or anyone who needs a less expensive monthly premium. Everyone can benefit from Comprehensive and Collision insurance, but it is especially important for inexperienced drivers who are more at risk of causing an accident. It’s also beneficial for those who have cars that are expensive to repair.

Not only is it illegal to not have auto insurance, but it also puts you and others in danger. To get the best deal on your auto insurance as well as expert guidance on selecting your perfect policy, contact us to get in touch with one of our insurance agents.