Whole vs. Term Life Insurance

Life insurance is essential for families. The two most common types of life insurance are Term and Whole. Keep reading for our expert tips to help you determine which type of policy will best meet your family’s needs.

All About Term

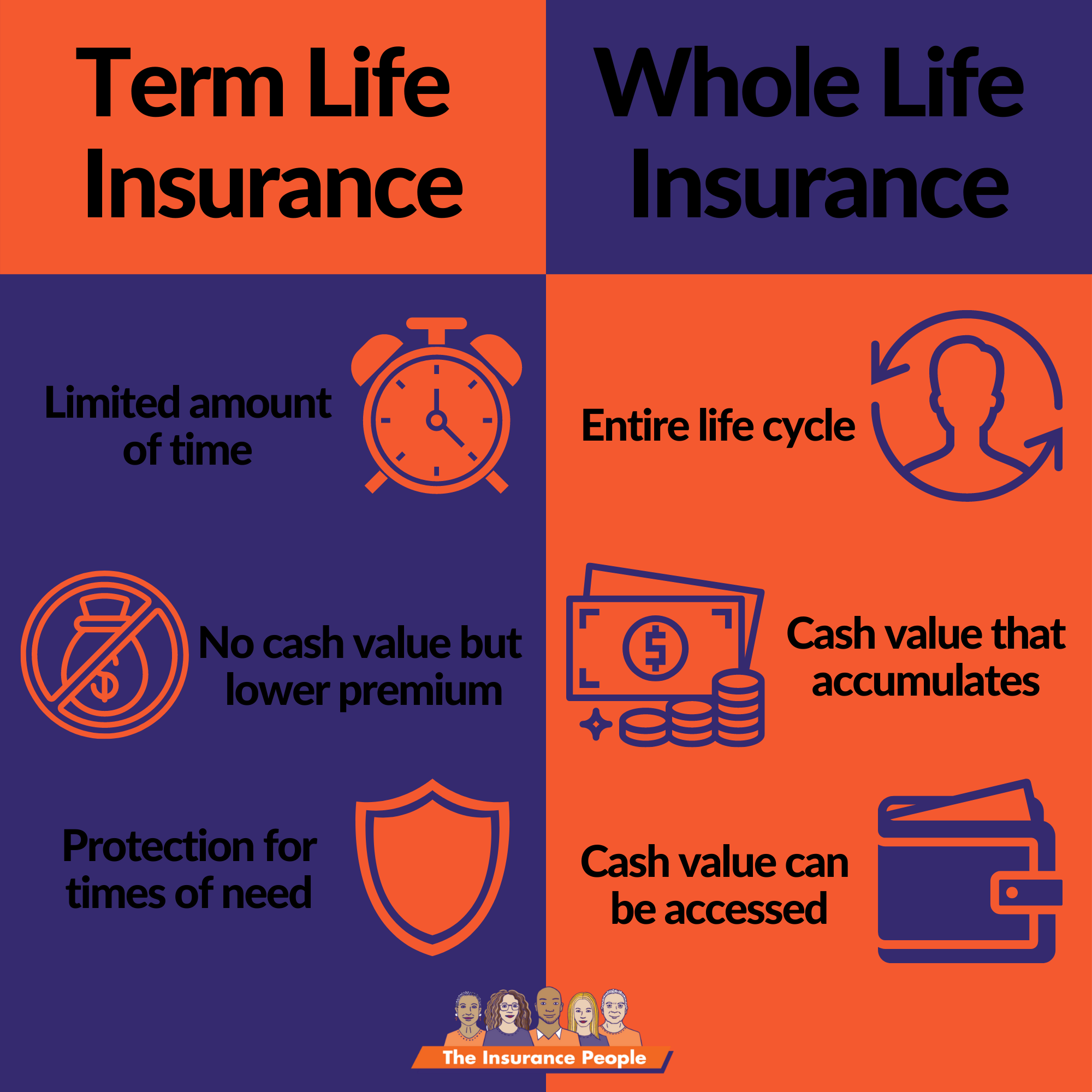

Term life insurance offers your family coverage for a fixed amount of time at an affordable monthly premium. Whether that time period is 10 or 30 years, you are covered for that timeframe at an approved price that locks in for the term length. This means that your beneficiaries receive the death benefit from the policy if you pass away during the duration of the policy. This type of insurance is price savvy and allows for most families to easily afford the right amount of insurance for their needs.

Most families need life insurance to create a death benefit for the surviving spouse and kids. When deciding the death benefit amount, most families want to make sure to cover their surviving spouse with income replacement, paying off large bills like home loans, and sending kids to college. In most situations, the term length matches getting kids to an age where they are independent or that you, the insured, are age 65.

All About Whole

Whole life insurance offers permanent coverage, and this comes at a higher cost. Whole life insurance is like owning a home - you build equity in the policy and that equity can grow the death benefit or be used to borrow against. Whole life insurance combines insurance death benefit with investing. The more you pay into your policy, the more your family will get out of it. The money accumulated is also tax-deferred, so taxes do not have to be paid while you are paying into it. You can also borrow money from your policy if needed, but this will lower the amount your beneficiaries receive if it’s not paid back. Whole life insurance comes with guaranteed benefits and higher costs, making it appropriate for families with higher incomes. It is not normally essential for everyday families life insurance needs.

Which Policy is Best for Me?

Term is your best option if:

You need lower monthly costs.

Your risk period is clear, like getting your kids to age 25 or the end of a loan term.

Whole is your best option if:

You want lifelong coverage for your family.

You can afford the monthly premium costs.

Life insurance is not one-size-fits-all for all families, but with a little research and a clear understanding of your family’s financial situation, you can choose the best coverage for your specific needs. If you’re looking for guidance in picking the right kind of policy, get in touch with one of our representatives.